Trouble ahead for Adobe Marketo Engage's Mid-Market Users

Executive Summary

- Adobe is moving Marketo Engage up-market to match its user base in the Experience Cloud, while meeting debt obligations for its acquisition activity means higher costs for end users

- CMOs will need to increase spend to buy more Experience Cloud products with more complexity to obtain new features that were previously included in Marketo

- Marketers need a greater understanding of their Go To Market processes in order to make informed product buying decisions to pivot with the upcoming shifts in Marketing Technology and its affect on their budgets

- Mid-market vendors and new technologies are beginning to emerge to fill feature gaps within the current marketplace.

Your MarTech vendors' financials affect your tech stack more than you know

While shifts in the cost of capital affects the entire SaaS industry, the shifts to competition within the marketing automation industry have caused just as substantial a change for Chief Marketing Officers and Marketing Directors. Here’s how that impacts your bottom line in 2024 and 2025 and what you should do to protect the financial results produced by your marketing efforts over the next few years.

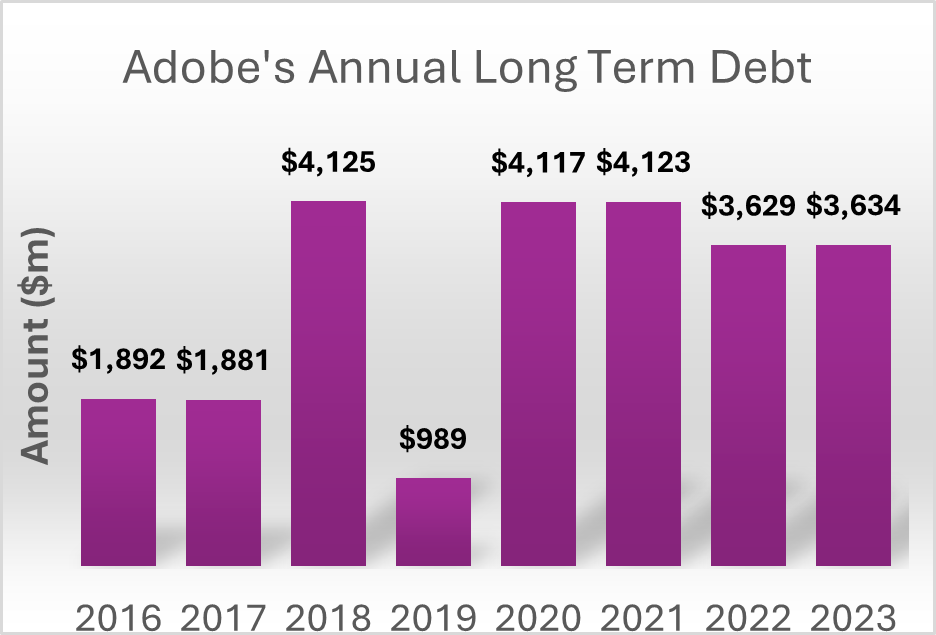

First, some context, we’re coming up to 8 years since the founders of Marketo originally sold their company to Vista Private Equity… then only 2 years later Adobe acquired the firm for a record $4.75 billion. With the debt involved in a deal of that size, Adobe more than doubled the long-term debt on its balance sheet from 2017 onward. At the same time, with Adobe’s footprint firmly entrenched in the enterprise B2C marketplace, there’s been a real shift to move Marketo up-market to service larger and larger clients with higher ACV (or Average Contract Value for everyone not in the SaaS world) to match the user base serving the other needs within the Adobe Experience Cloud.

But as Adobe moves its products and services network to cater to the largest enterprises, what does this mean for mid-market enterprises? The marketers responsible for firms between $30 million to $100 million still have very complicated Go To Market needs… many have different sales intermediaries like dealers or distributors involved in filling their pipeline with new and returning customers. Some have more than one CRM or Sales Enablement platform across their organization, for example.

Yet their marketing budgets and internal capabilities to handle the sophistication required by today’s proprietary clouds is inaccessible to more and more firms in this category. They need a tool that handles complexity without the Total Cost of Ownership that only the Fortune 500 can afford. This has a direct impact on the profitability of a marketing program, and puts marketers in a difficult position to consider the initial switching costs of a migration to a more cost effective platform when a price increase isn't feasible. But what platform should they migrate to becomes the greater question?

By the Numbers

Adobe's long-term debt more than doubled from 2017 onward, fueled in-part from acquisition costs with Marketo and Magento.

Historically, Marketo built its brand positioning as the disruptor offering a breadth of features at a reasonable price compared to Eloqua. But as time, economics, and the marketing automation industry matured, that value proposition is changing. Marketers, you need to consider these trends as you make long-term investments in your marketing technology stack.

Increasing software costs for fewer new features

As a warning to mid-market CMO’s, even if you decline to buy any additional Experience Cloud products, look out for higher prices coming to your software contract renewals over the next two years. Yes, there’s always a desired growth factor in the price per seat of a SaaS product. However, now there’s now an effort to grow their share of wallet with your marketing tech spend to make additional purchases for features that used to be included.

Judging by the product announcements over the past two Adobe Summit events, you can expect to see an increasing expense of having to purchase and implement multiple products like Adobe Analytics or Adobe Customer Journey Analyzer instead of using the features that were historically included in Marketo like Revenue Cycle Analytics.

Cloud to Cloud Competition

Similarly to the competition to address feature sets within Adobe Experience Cloud, we’re also seeing increased competition between the various clouds servicing the mid-market enterprise: Adobe, Salesforce, HubSpot, and Microsoft.

Salesforce Marketing Cloud vs. Adobe Marketo Engage

At the time of the Marketo acquisition, Salesforce was the primary CRM used by organizations when integrating with Marketo. However, when Salesforce bought Pardot and ExactTarget, it began to almost “give away” those marketing automation licenses when renewing a Salesforce CRM contract to win market share from Marketo. Clearly this caused a rift in the relationship between the two software firms and left many CMOs with a difficult choice: justify the perceived higher costs of keeping Marketo, or pay the migration costs to implement Pardot or Salesforce Marketing Cloud. What's further challenging is that the marketers who chose the Pardot migration found their pricing return to parity with Marketo, yet they still faced reduced functionality.

Microsoft Dynamics vs. Adobe Real Time CDP

Adobe wisely shifted its strategy towards supporting Microsoft Dynamics as its CRM of choice. However, there is still quite a bit of work involved in the Marketo-Dynamics integration. You can see this when syncing Dynamics Custom Objects in a Marketo Smart List. Or using a Campaign in Dynamics CE from a Marketo Default Program. While those shortcomings have been known for many years, they may never be fully addressed. Instead, we’ve seen Marketo’s product development increasingly geared towards Adobe’s Real Time CDP instead of Dynamics in recent years.

For Microsoft’s part, it's also started to reignite (pun intended Microsoft fans), it’s own marketing cloud and Customer Journey software efforts after largely abandoning ClickDimensions. These initially appear to be direct competitors to products within the Adobe Experience Cloud. Should a Marketer move towards Microsoft Dynamics or will future development require Adobe Real Time CDP isntead?

The Rise of HubSpot and other Mid-Market platforms

Without the overhead costs involved in mergers and acquisitions elsewhere, HubSpot has maintained its own steady focus on developing its suite of products to fill the gaps as Adobe, Salesforce, and Microsoft move upwards. For example, we’re similarly seeing a rise of HubSpot’s CRM as a viable challenger to those wishing to escape the increasing costs in Salesforce’s Sales Cloud.

As HubSpot MarketingHub software continues its rapidly development, it provides a more compelling reason to consider it as a Marketo alternative for those building a straightforward tech stack. However, if a Google acquisition for HubSpot happens, what effect will that have on future development within its own product cloud? Would, for example, we see a HubSpot branded multi-touch attribution product powered by Google’s domain knowledge around Paid Media?

Does that help today’s CMO? Not necessarily, and definitely not if you’ve already firmly invested your money and processes around Salesforce.

The Lesson for Marketing Leaders: Understand your Go-To-Market Process to drive your MarTech purchases

For marketers, this shifting SaaS marketplace presents a real challenge to make long-term purchase decisions. You really can’t realize the full value of a marketing technology product if you switch it after just one year. But if buying one product means that you have to buy an entire suite of products, can your firm handle those extra costs?

That doesn’t cover the implementation costs as well. The same mergers and acquisitions activity in software firms has also happened within service partners as well. Which means you’re left with a decreasing number of service providers who need to charge higher prices to cover their increased overhead costs. If you have a budget for Deliotte Accenture, or BDO Digital to implement multiple products of the Adobe Experience Cloud into your firm, this isn’t an issue. But for mid-market enterprises, that’s a hefty price tag with a high switching cost to be dependent on one vendor if an issue arises.

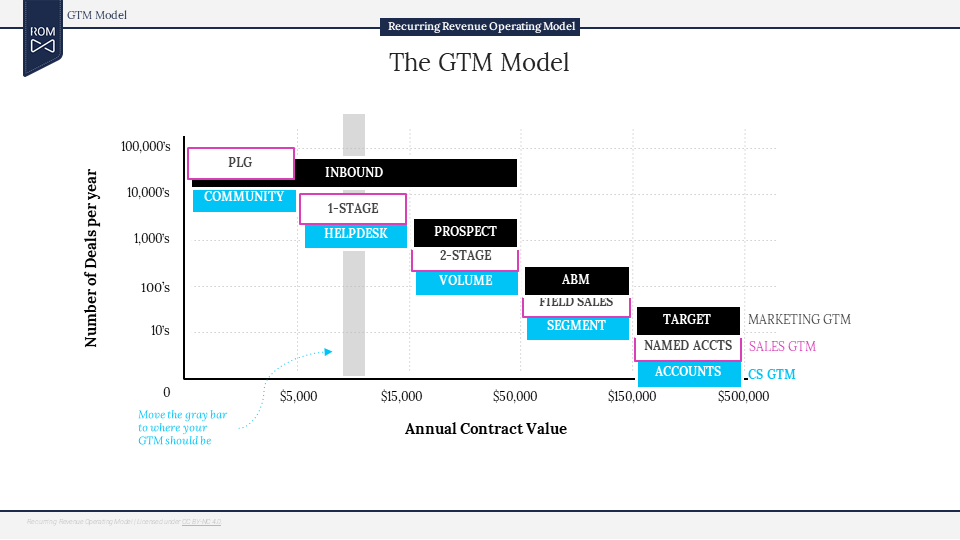

Instead, it’s worth focusing on your Go To Market process… how do you create value and what are the motions you use to measure conversion rates for new buyers within your customer journey? Today when we work with a firm at Conversion Store, we’re considering where it lands on Winning By Design’s GTM Model. In the diagram below, you can see that your Opportunity volume and your Average Contract Value have a direct impact on your tech stack needs to support your Sales and Marketing process.

In 2024 and 2025, when you’re coming to the table to renew your software contracts, don’t show up empty handed. It's worth documenting your business model now with a firm understanding of how your technology stack supports this. The rising interest rate environment directly impacts your vendors, which also will impact the cost to run your marketing program.

Subscribe to our Blog

Read the latest updates and insights about how to make the most of your marketing technology to meet your business and revenue goals.

Contact Us

We will get back to you as soon as possible.

Please try again later.

CONTACT US

Call Us

hello@ConversionStore.com

Mailing Address:

Conversion Store Inc.

52A Ervin St.

Belmont, NC 28012

USA

USEFUL LINKS

STAY INFORMED

All Rights Reserved | Conversion Store Llc.